Efficient market hypothesis - I

Table of Contents

A. Using Multi-factor model

1. Fama-French (FF) 3 Factor Model

Fama and French 3 factor model is a standard model for analyzing stock returns. Built upon the observation that firm size and the book-to-market ratio historically explain stock returns.

MVSP = P x # of shares outstanding

Observation: Smaller firms have higher beta; more-than average returns.

- Conclusion: Smaller firms haver higher returns that what the CAPM would predict; This deviation is not captured by the CAPM. This missing factor was the FIRM SIZE.

2. Fama-French (FF) - 3 Factors model

-

Market Index Excess Return:

-

Small Minus Big (SMB) Index Excess Return:

- Difference between the returns of small and big firms

-

High Minus Low (HML) Index Excess Return:

- Difference between the returns of high and low book-to-market firms

Kahoot! Q1: If the TRUE model of expected returns is the 10 Fama French 3 factor model:

An analyst instead estimates the CAPM index model:

What is the

(2) Greater than 3%, less than 5%

3. Omitted Systematic Factors

-

Fama-French 3-factor model is better than the singleindex CAPM at explaining stock returns because it includes important factors.

-

Single-index CAPM fails to explain the returns on too many stocks

B. Random Walks and the Efficient Market Hypothesis

1. Efficient Market Hypothesis (EMH)

-

If markets are efficient:

- On average, investors cannot earn risk-adjusted positive profits

-

If markets are not efficient:

- active strategies should eaarn risk-adjusted positive profits and outperform passive strategies

2. Competition

- Once information becomes available, market participants quickly analyze it and trade on it.

Competition may not imply information efficiency when:

- Information is not available to all market participants

3. Random Walks

Why is there a postive trend?

- Investors are risk averse average and they demand for positive risk premiums. They on average invest in stocks with positive risk premiums.

- Firms invest in postive NPV projects and grow on average

- Survivorship Bias. What about the firms performing poorly consistently? Kicked out

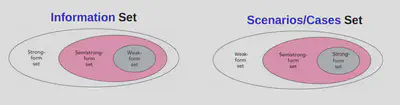

4. EMH: Three Forms

-

Weak Form: Prices reflect all past information (historical prices and trading data)

- if markets are weak-form efficient, investors can never construct a strategy with positive risk-adjusted returns using using historical price and trading data.

-

Semi-Strong Form: Prices reflect all public information

- if markets are semi-strong-form efficient, investors can never construct a strategy with positive risk-adjusted returns using growth forecasts, accounting statements, past price, volume data & earnings

-

Strong Form: Prices reflect all information: both public and private

- if markets are strong-form efficient, investors can never construct a strategy with positive risk-adjusted returns using any information (public or private)

-

Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume.

-

Fundamental analysis, which attempts to evaluate a security’s value based on business results such as sales and earnings.